Hey there, friend! Ever heard of social security identity verification? If not, let me break it down for you. In today's digital world, protecting your personal information is more important than ever. Social security numbers are like the golden key to your identity, and if someone gets ahold of it, well, let's just say it can turn into a massive headache. So, buckle up, because we're diving deep into everything you need to know about verifying your social security identity.

Think about it—your social security number is like your digital fingerprint. It's tied to your credit, taxes, employment history, and so much more. If someone steals it, they can open accounts, file fake tax returns, or even commit crimes under your name. Scary stuff, right? That's why understanding how social security identity verification works is crucial. We'll cover everything from the basics to advanced tips, so you're fully armed against identity theft.

Now, before we dive into the nitty-gritty, let me assure you this isn't just another boring article. We're keeping it real, breaking things down in a way that's easy to digest. Whether you're a tech wizard or someone who barely knows what a firewall is, this guide has got you covered. Let's get started!

Read also:How To Create Mirror Illusion Photos That Look Like Yoursquore Your Own Man

What is Social Security Identity Verification?

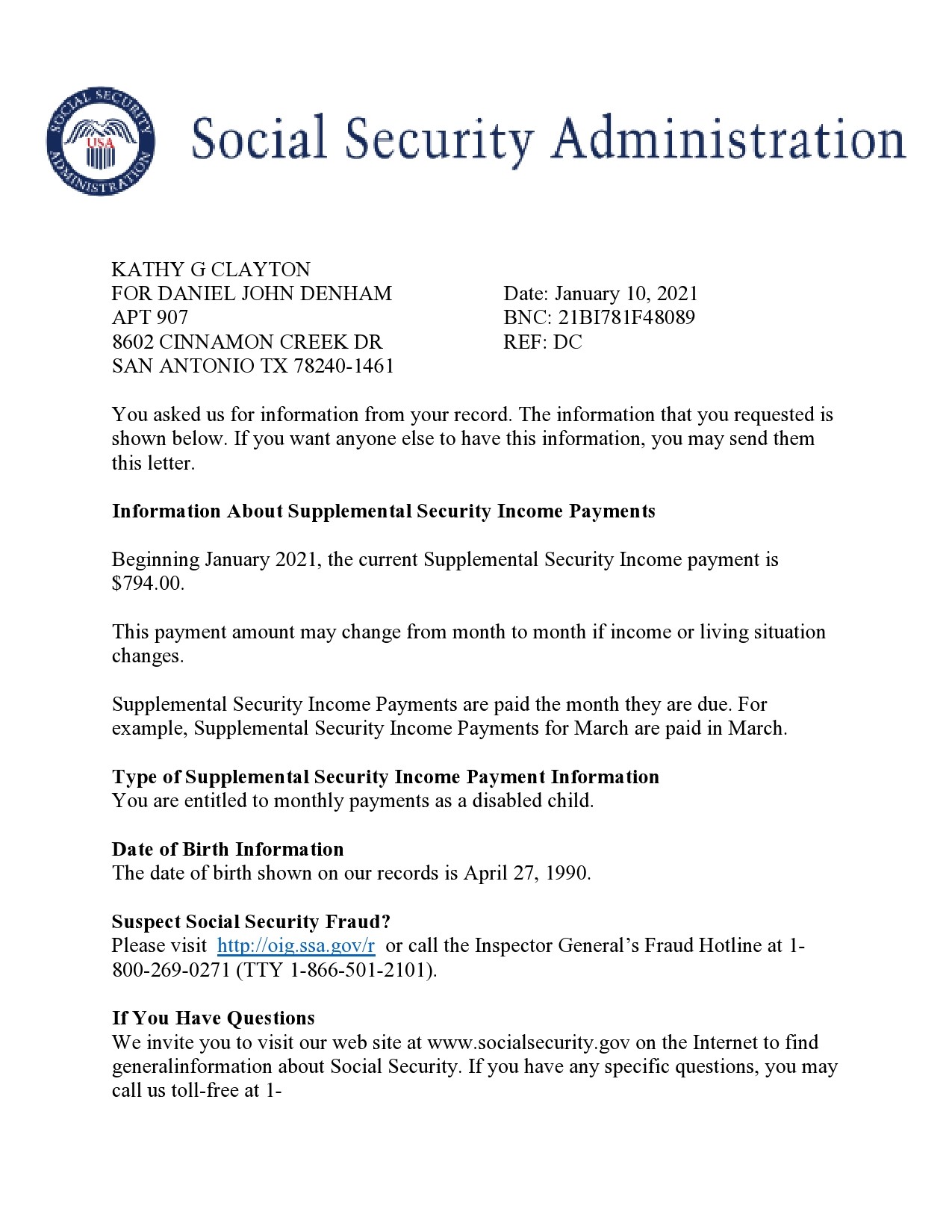

Alright, let's start with the basics. Social security identity verification is the process of confirming that the social security number (SSN) you're using actually belongs to you. This is super important because, as I mentioned earlier, your SSN is like the master key to your identity. When someone verifies your SSN, they're essentially making sure no one else is using it for shady stuff.

Here's the thing: SSNs weren't originally designed for identity verification. Back in the day, they were just used to track your earnings for Social Security benefits. But over time, they've become the go-to identifier for pretty much everything. So, when you apply for a loan, open a bank account, or even sign up for a new job, they'll usually want to verify your SSN.

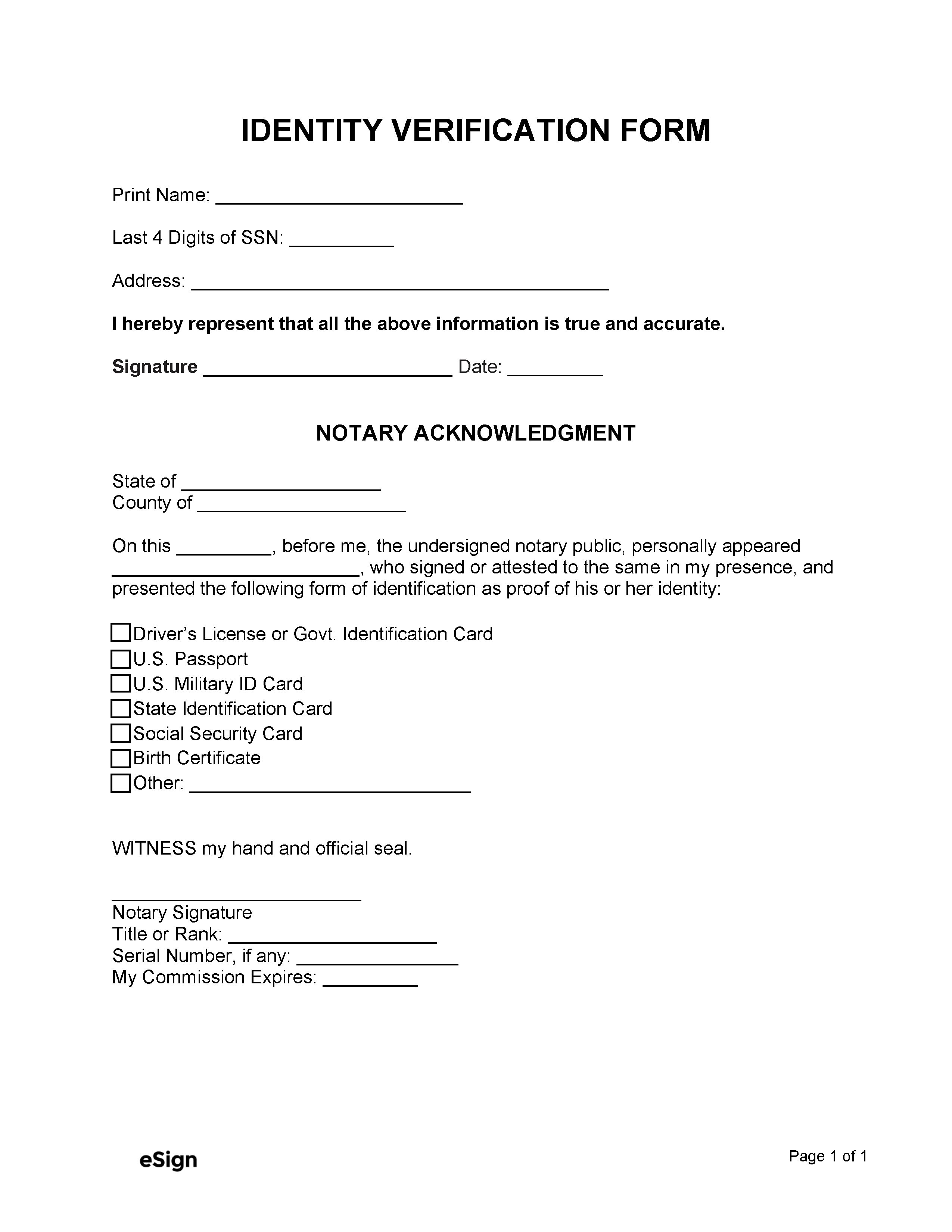

Now, there are different ways to verify your SSN. Some companies use third-party services, while others might ask for additional documents like your birth certificate or passport. The goal is always the same: to make sure the SSN matches the person it's supposed to belong to.

Why is Social Security Identity Verification Important?

Here's the deal: identity theft is a massive problem, and it's only getting worse. In 2022 alone, the Federal Trade Commission (FTC) reported over 460,000 cases of identity theft involving SSNs. That's a lot of people whose lives were turned upside down because someone stole their personal info.

When your SSN gets compromised, the consequences can be devastating. Imagine waking up one day to find out someone has opened a bunch of credit cards in your name, racked up huge debts, and skipped town. Or worse, they've filed a fraudulent tax return and pocketed your refund. It's not just a financial nightmare—it can also damage your credit score and make it harder to get loans or even rent an apartment.

That's why social security identity verification is so crucial. By verifying your SSN regularly, you can catch any suspicious activity early on and take steps to protect yourself. Plus, it gives you peace of mind knowing that your identity is safe.

Read also:Roaring Twenties Dti The Ultimate Guide To Unlocking Your Financial Future

Common Methods of Social Security Identity Verification

Now, let's talk about the different ways companies and organizations verify your SSN. Here are a few of the most common methods:

- Third-Party Verification Services: Many businesses use specialized services to verify SSNs. These services cross-check the SSN against government databases to ensure it's legitimate.

- Document Verification: Some organizations might ask for additional documents, like your birth certificate, passport, or driver's license, to confirm your identity.

- Online Verification Tools: There are several online tools available where you can verify your own SSN. These tools usually require you to answer security questions or provide additional personal information.

- Government Agencies: In some cases, you might need to visit a government office in person to verify your SSN. This is often required for things like applying for a passport or Social Security benefits.

Each method has its pros and cons, so it's important to choose the one that works best for your situation. For example, if you're in a hurry, an online verification tool might be the fastest option. But if you need a more official confirmation, visiting a government office might be the way to go.

How to Protect Your Social Security Number

Okay, so now that you know why social security identity verification is important, let's talk about how to protect your SSN. Here are a few tips to keep your personal info safe:

- Don't Carry Your SSN Card: Leave your Social Security card at home unless you absolutely need it. The fewer places it goes, the less likely it is to get lost or stolen.

- Be Cautious Online: Never share your SSN over unsecured websites or public Wi-Fi networks. Always make sure the site is legitimate and uses encryption (look for "https" in the URL).

- Shred Sensitive Documents: If you have any papers with your SSN on them, shred them before throwing them away. Identity thieves love going through trash, so don't make it easy for them.

- Monitor Your Credit Report: Regularly check your credit report for any suspicious activity. If you notice something fishy, report it immediately.

Remember, protecting your SSN is all about being proactive. The more vigilant you are, the less likely you are to become a victim of identity theft.

Understanding Identity Theft and Its Impact

Let's take a moment to talk about identity theft and why it's such a big deal. Identity theft happens when someone steals your personal information, like your SSN, and uses it for fraudulent purposes. It can happen in a variety of ways, from hacking into databases to stealing your mail.

The impact of identity theft can be devastating. Victims often spend months or even years cleaning up the mess left behind by thieves. They might have to deal with debt collectors, repair their credit score, or even prove they're the real owner of their own identity. It's a long and frustrating process that no one wants to go through.

That's why prevention is key. By taking steps to protect your SSN and regularly verifying your identity, you can reduce your risk of becoming a victim. And if the worst does happen, knowing what to do can help you recover faster.

Steps to Take if Your SSN is Stolen

Alright, so what happens if your SSN does get stolen? Don't panic—there are steps you can take to minimize the damage. Here's what you should do:

- File a Report: Contact the Federal Trade Commission (FTC) and file an identity theft report. This will help you get started on the recovery process.

- Freeze Your Credit: Place a credit freeze on your accounts to prevent new accounts from being opened in your name. You can do this by contacting the three major credit bureaus: Equifax, Experian, and TransUnion.

- Notify Financial Institutions: Reach out to your bank, credit card companies, and other financial institutions to let them know your SSN has been compromised.

- Monitor Your Accounts: Keep a close eye on your accounts for any suspicious activity. Report anything unusual immediately.

While it's not fun to think about, being prepared can make a huge difference if your SSN is stolen. The quicker you act, the better your chances of minimizing the damage.

Advancements in Social Security Identity Verification Technology

Technology is constantly evolving, and so are the methods for social security identity verification. These days, companies are using more advanced tools to verify SSNs, like biometric scans, facial recognition, and AI-powered algorithms. These technologies make it harder for fraudsters to get away with identity theft.

For example, some banks now use fingerprint or facial recognition to verify your identity when you log in to your account. This adds an extra layer of security and makes it much harder for someone else to access your info. Similarly, AI-powered systems can detect unusual patterns in your account activity and flag them for review.

Of course, no system is perfect, but these advancements are definitely helping to make social security identity verification more secure. As technology continues to improve, we can expect even better solutions in the future.

Legal Protections for Social Security Identity Theft Victims

Now, let's talk about the legal side of things. If you're a victim of social security identity theft, there are laws in place to protect you. The Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACTA) give you certain rights when it comes to disputing fraudulent activity on your credit report.

Under these laws, you have the right to:

- Request a free copy of your credit report from each of the three major credit bureaus.

- Dispute any inaccurate information on your credit report and have it corrected or removed.

- Place a fraud alert on your credit file to warn creditors of potential identity theft.

These protections can be a huge help if you're trying to recover from identity theft. Make sure you take advantage of them to protect your rights and get your life back on track.

Best Practices for Social Security Identity Verification

Finally, let's wrap up with some best practices for social security identity verification. Whether you're an individual or a business, following these tips can help ensure your SSN is verified accurately and securely:

- Use Secure Channels: Always verify SSNs through secure channels, like encrypted websites or in-person visits to government offices.

- Limit Access: Only share your SSN with trusted organizations that have a legitimate need for it.

- Regularly Verify: Make it a habit to regularly verify your SSN and monitor your accounts for any suspicious activity.

- Stay Informed: Keep up with the latest trends and technologies in social security identity verification to stay ahead of potential threats.

By following these best practices, you can help protect your identity and reduce your risk of becoming a victim of fraud.

Conclusion

And there you have it, folks! Social security identity verification is an essential part of protecting your personal information in today's digital world. By understanding how it works, taking steps to protect your SSN, and knowing what to do if it gets stolen, you can keep your identity safe and secure.

So, what are you waiting for? Go ahead and verify your SSN today. And don't forget to share this article with your friends and family so they can stay protected too. Together, we can fight back against identity theft and make the world a safer place for everyone. Stay safe out there!

Table of Contents

Social Security Identity Verification: The Ultimate Guide to Protecting Your Personal Data

What is Social Security Identity Verification?

Why is Social Security Identity Verification Important?

Common Methods of Social Security Identity Verification

How to Protect Your Social Security Number

Understanding Identity Theft and Its Impact

Steps to Take if Your SSN is Stolen

Advancements in Social Security Identity Verification Technology

Legal Protections for Social Security Identity Theft Victims