Let’s cut to the chase, folks. The roaring twenties DTI isn’t just some buzzword; it’s a financial strategy that’s got everyone talking. Imagine having a roadmap to your financial independence, where every dollar you earn works harder for you. That’s exactly what the DTI (Debt-to-Income) ratio in the roaring twenties is all about. Whether you’re a millennial trying to crush student loans or a seasoned investor aiming for early retirement, understanding this concept can be a game-changer.

Now, before we dive deep into the nitty-gritty, let’s get one thing straight. The roaring twenties DTI is more than just a number. It’s a lifestyle shift, a mindset tweak, and a financial blueprint. Think of it as your personal finance GPS, helping you navigate through the chaos of modern-day expenses while keeping your eyes on the prize: financial freedom.

So, buckle up, because we’re about to take a ride through the world of DTI, exploring its ins and outs, debunking myths, and giving you actionable tips to supercharge your financial journey. By the end of this, you’ll be armed with the knowledge to not only understand your DTI but also optimize it for maximum impact.

Read also:Yung Gravy Costume Spice Up Your Look With The King Of Flavor

Table of Contents

- What is DTI and Why Does it Matter?

- A Brief History of DTI in the Roaring Twenties

- How to Calculate Your DTI Ratio

- Why DTI is Crucial for Financial Health

- The Roaring Twenties DTI Phenomenon

- Effective Strategies to Lower Your DTI

- DTI’s Impact on Your Credit Score

- Long-Term Benefits of Managing DTI

- Common Mistakes to Avoid with DTI

- Final Thoughts: Your DTI Journey Starts Here

What is DTI and Why Does it Matter?

Alright, let’s break it down. DTI stands for Debt-to-Income ratio, and it’s basically a financial metric that compares how much you owe to how much you earn. It’s like checking the health of your wallet. If your DTI is high, it means you’re spending more on debt than you’re bringing in, which ain’t good news. But if it’s low? Congrats, you’re on the right track.

Now, why does this matter? Well, lenders, banks, and financial institutions love DTI. It’s their go-to tool to decide if you’re worthy of that dream mortgage or that shiny new car loan. Think of it as your financial report card. A low DTI ratio screams responsibility and reliability, making you a top candidate for loans and credit cards.

And let’s not forget, your DTI affects more than just loans. It impacts your credit score, your ability to save, and even your peace of mind. So yeah, it’s kinda a big deal.

A Brief History of DTI in the Roaring Twenties

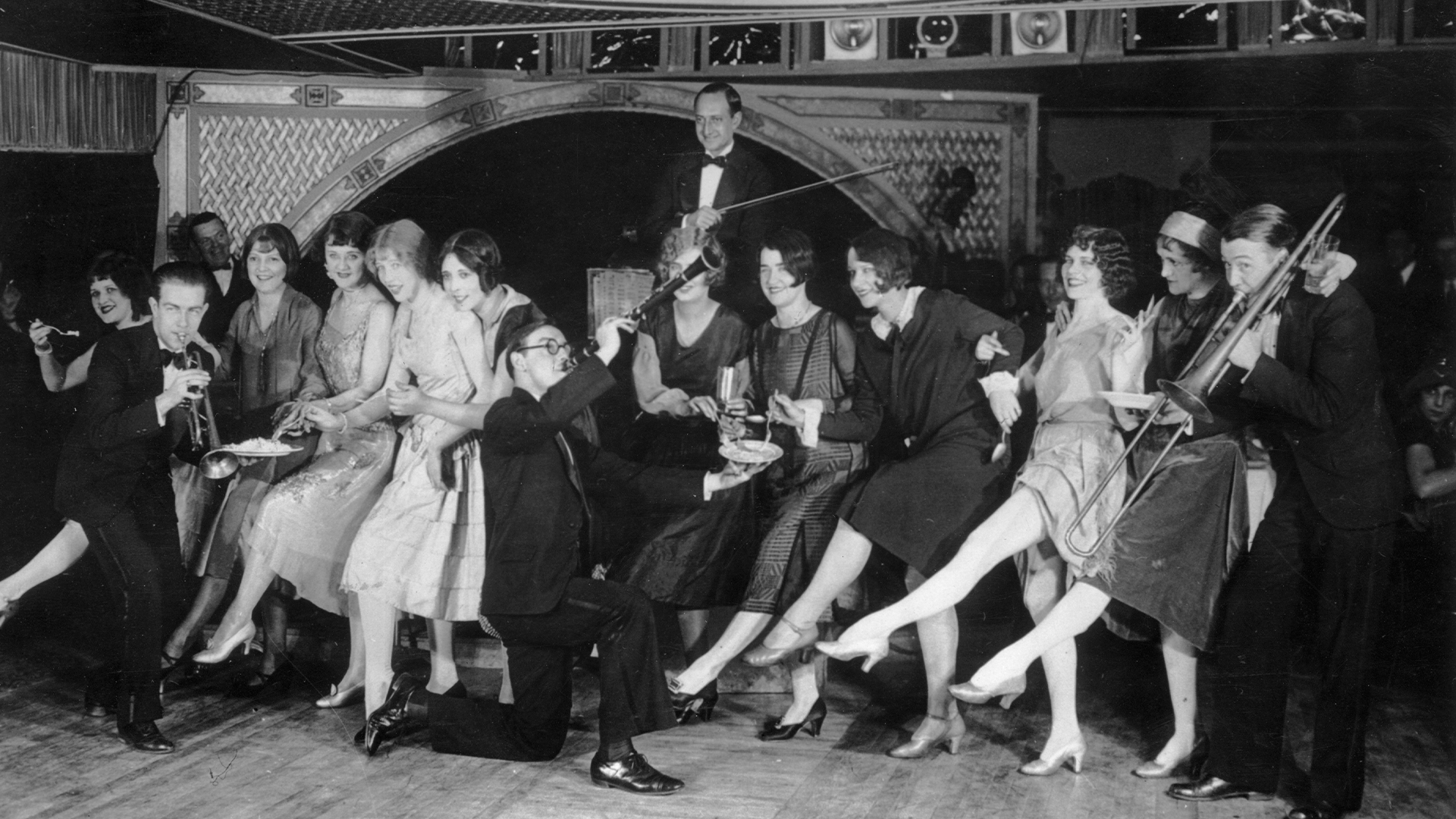

Back in the real roaring twenties, the world was all about jazz, flappers, and economic boom. But guess what? Even then, people were wrestling with debt. The concept of DTI wasn’t as formalized, but the idea was there. Folks were borrowing big for cars, homes, and businesses, and some were getting in over their heads.

Fast forward to today’s roaring twenties, and DTI has become a cornerstone of financial health. With the rise of digital banking and financial apps, tracking your DTI is easier than ever. But the core idea remains the same: keep your debt in check, and you’ll thrive.

Fun fact? The 1920s also saw the birth of credit unions, which were all about helping people manage debt. Kinda like a proto-DTI strategy, if you think about it.

Read also:Messymaj Magic Fight The Ultimate Showdown You Cant Miss

How to Calculate Your DTI Ratio

Alright, time for a little math, but don’t worry, it’s not rocket science. To calculate your DTI, you need two things: your monthly debt payments and your monthly gross income. Here’s the formula:

(Total Monthly Debt Payments / Gross Monthly Income) x 100 = DTI Ratio

Let’s say you pay $1,000 a month on your mortgage, $300 on car loans, and $200 on credit cards. That’s $1,500 in monthly debt. If your gross monthly income is $5,000, your DTI would be:

(1,500 / 5,000) x 100 = 30%

And there you have it, a DTI of 30%. Not bad, but we’ll talk more about ideal ratios later.

Breaking Down the Numbers

Here’s a quick breakdown:

- 36% or lower: Good DTI, you’re in the clear.

- 37% to 49%: Okay, but could use some work.

- 50% or higher: Danger zone, time to take action.

Remember, the lower your DTI, the better your financial standing.

Why DTI is Crucial for Financial Health

Your DTI ratio is like the pulse of your financial health. A high DTI can lead to stress, missed payments, and even bankruptcy. On the flip side, a low DTI opens doors to better credit opportunities, lower interest rates, and financial stability.

Think about it. When you apply for a loan, the lender wants to know if you can handle the payments. A low DTI says, “Yes, I’ve got this,” while a high DTI says, “Uh, maybe not.” It’s that simple.

Plus, managing your DTI helps you build wealth over time. By reducing debt and increasing savings, you’re setting yourself up for long-term success. And who doesn’t want that?

The Roaring Twenties DTI Phenomenon

So, what makes DTI so special in today’s roaring twenties? Well, it’s all about the times we live in. With the rise of gig economy jobs, student loans, and housing costs, managing debt has never been more crucial.

But here’s the kicker: technology has made it easier than ever to monitor and improve your DTI. Apps like Mint, PocketGuard, and YNAB (You Need A Budget) help you track expenses, manage debt, and optimize your income. It’s like having a personal finance assistant in your pocket.

And let’s not forget the power of community. Online forums, podcasts, and social media groups are filled with people sharing tips and tricks to lower their DTI. It’s a movement, folks, and you can be a part of it.

Tech Tools for DTI Management

Here are some tech tools you should check out:

- Mint – For budgeting and debt tracking.

- YNAB – For creating a zero-based budget.

- Personal Capital – For tracking investments and net worth.

These tools are your secret weapons in the fight against debt.

Effective Strategies to Lower Your DTI

Alright, time to get practical. Here are some strategies to lower your DTI:

1. Pay Down High-Interest Debt

Focus on those pesky credit card balances. The higher the interest rate, the more it eats into your income. Use the snowball or avalanche method to tackle these debts head-on.

2. Increase Your Income

Side hustles, anyone? Whether it’s freelancing, driving for Uber, or selling stuff online, every extra dollar helps lower your DTI.

3. Refinance Loans

If you’ve got loans with high interest rates, consider refinancing. Lower rates mean lower payments, which means a lower DTI.

Remember, every little step counts. It’s like losing weight; small changes add up over time.

DTI’s Impact on Your Credit Score

Your DTI and credit score are like two peas in a pod. While DTI isn’t directly factored into your credit score, it indirectly affects it. Lenders look at your DTI to determine your creditworthiness, and a high DTI can lead to higher interest rates and less favorable terms.

On the flip side, a low DTI shows lenders that you’re responsible with debt, which can boost your credit score over time. It’s a win-win situation.

So, if you’re aiming for that dream credit card or mortgage, keep your DTI in check. It’ll do wonders for your credit profile.

Credit Score Myths Debunked

Here are some common myths:

- Checking your credit score lowers it – False.

- Carrying a balance improves your score – False.

- DTI is part of your credit score – False.

Knowledge is power, folks. Arm yourself with the facts.

Long-Term Benefits of Managing DTI

Managing your DTI isn’t just about short-term gains; it’s about setting yourself up for long-term success. Here’s how:

First, you’ll have more financial freedom. With lower debt payments, you can save more, invest more, and enjoy life more. Second, you’ll build a stronger credit profile, opening doors to better financial opportunities. And third, you’ll reduce stress. Let’s face it, debt stress ain’t fun.

Think about it. By managing your DTI today, you’re investing in your future. You’re creating a financial foundation that will serve you well for years to come.

Common Mistakes to Avoid with DTI

Now, let’s talk about the mistakes. Here are a few to avoid:

1. Ignoring Your DTI

Don’t stick your head in the sand. Ignoring your DTI won’t make it go away. Face it head-on and take action.

2. Taking on Too Much Debt

Just because you can afford the payments doesn’t mean you should take on the debt. Always consider the long-term impact.

3. Not Planning for the Future

Don’t live paycheck to paycheck. Create a financial plan that includes savings, investments, and debt reduction.

Remember, your DTI is a tool, not a burden. Use it wisely.

Final Thoughts: Your DTI Journey Starts Here

So, there you have it, folks. The roaring twenties DTI isn’t just a number; it’s a key to unlocking your financial potential. By understanding, calculating, and managing your DTI, you’re taking control of your financial future.

Here’s a quick recap:

- Know your DTI ratio and what it means.

- Use tech tools to track and optimize your DTI.

- Implement strategies to lower your DTI.

- Understand the impact of DTI on your credit score.

- Avoid common mistakes and plan for the future.

Now, it’s your turn. Take action. Share this article with a friend. Leave a comment. Let’s start a conversation about financial health. Because, at the end of the day, your money matters, and so does your life.